Hello friends!

The upcoming months are full of anticipation and uncertainty as society begins to reopen. The strength of the economy is based on consumer confidence which will be highly dependent on safety, both actual and perceived. The COVID-19 pandemic and a potential recession arriving at nearly the same time can feel scary, but if you’re in the market for a home, you might be able to make it work for you.COVID-19 has certainly made things more complicated, but the stayathome orders have not stopped home sales completely. The National Association of Realtors (NAR) warns that shutdowns have affected every aspect of homebuying, including brokerage operations, how listings are being marketed, and closing transactions. Though many states have classified real estate as “essential ser-vice”. I am still out on field for showings, inspections and walkthroughs. If you are in the process of buying a home, the novel coronavirus does not have to stop you, rates are still low, as long as your job is secure and you have your financials in a row, you may be able to get a good deal on a property.

Market analysis shifted from annual, quarterly and monthly reports to daily reports based on 7day moving averages, with each new report offering insights without precedence. Thereare still lot of questions and uncertainty. We found ourselves in uncharted waters. On March 12 we saw a sudden rise in temporarily offmarket listings. On March 13 the volume of listings falling from contract increased, at the same time listings going under contract fell. On March 17 we saw a surge in new listings. And on March 24 we saw the median original list price for new listings fall. The ARMLS data and the charts gives us a peek into it.

Where as, Investors are facing additional challenges as hard money lenders are withdrawing from the market completely or raising rates. Wholesalers are facing a multitude of challenges as well. We’re seeing a jump in virtual tours as agents and prospective buyers adapt to social distancing guidelines. Demand for new homes is falling and will continue to drop into the third quarter according to Belfiore Real Estate consulting. Real Estate investors that fix and flip will see their market share of sales increase in April. Covid-19 will not keep their finished projects off the market. Their purchases are leveraged, and the houses are vacant. Time is money. Their challenges will lie in acquiring new inventory. Our market will adapt to the challenges Covid-19 presents. Investors like i-buyers have suspended home buying activity. We will see limited buying and selling activity in April as they only honor prior contracts. Foreclosure activity in April will be very light. We have seen a limited number of new notices and virtually no actual foreclosures,The reason forbearance, though indication is foreclosures will be coming in market, though it wont be as bad as last recession.

Now let’s see how valley is doing, here is a look for March sales of Residential Properties in Maricopa County-

â—Total Sales for Single Family, Town-home, Condos for March are 7,436 whereas, February was 6,345 and January were 5,473

â—The Active listings for Single Family, Town-home, Condos for March are 13,671 whereas, February was 12,334 and January were 12,575

â—Pending sales for Single Family,Town-home, Condos for March are 5,645 whe-reas, February was 6,031 and January were 5,519

The total home sales by financing were-

Cash Sales- 1,238

Conventional- 4,268

FHA- 892

VA- 541

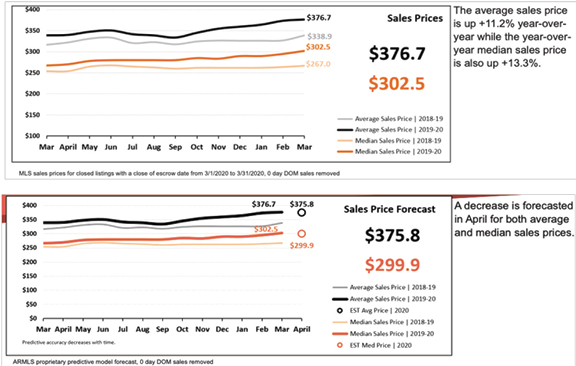

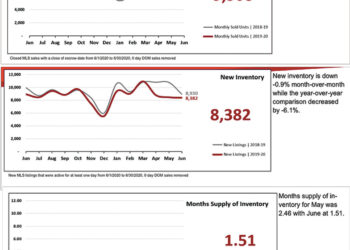

Here is the Quarter-1 Market report from Armls, if you look at it the inventory for this year was lower then 2018 and 2019, whereas, the sales where higher than 2019 and close to 2018 first quarter. The first quarter of 2020 reported the highest gross dollar volume sales in ARMLS history!. ARMLS sales volume for the first quarter was 11.1% higher than last year, median sales price was up 13.3% in March yearoveryear; average sales price was up 11.2% yearoveryear and the average price per square foot was up 9.3% in Maricopa County yearoveryear.

Currently Listings under contract are a leading indicator of future closings. The Volume of Listings Going Under Contract chart shows a widening gap between 2019 and 2020. We have to see how April month stats are coming.

Let’s take a look at the March sales of Residential Properties in Pinal County-

â—Total Sales for Single Family, Town-home, Condos for March are 977 whereas, February was 654 and January were 654

â—The Active listings for Single Family, Town-homes, Condos for March are 1633 whereas, February was 1,681 and January were 1,681

â—Pending sales for Single Family, Town-homes, Condos for March are 862 whe-reas February was 843 and January were 846

Here is the Quarter-1 Market report from Armls, closed sales where higher than 2018 and 2019.

Let’s look at the Commercial side-

The biggest challenges in commercial real estate will be related to the number of people employed in the service industries, such as retail and restaurants as well as tourism. Retail was vulnerable before the virus; the effects may go beyond short term. Commercial market may take a bigger hit than Residential.

Already I am seeing news of layoffs in commercial sectors, many companies are in verge of closing. Big investments on acreage deals are pulling out, though dis-tribution and warehouse space will be in demand as this Pandemic have forced more people to shop online and those habits will increase online retailer demand for distribution space in the city.Several tenants are stating they will not be paying rent, at least temporarily. While landlords may have stronger legal rights, es-pecially when it comes to receiving rent payments, they should seriously consider negotiating with tenants. Otherwise, they may find themselves with unwanted va-cancies, limited options to collect rents, and little or no revenue to pay their own expenses. Also, tenants need to recognize that landlords are facing unprecedented levels of requests for rent relief and it may not be feasible for landlords to grant rent relief. Both parties can consider options such as Rent Reduction or deferred Rent. Landlord can think of reducing tenant’s rent for sometime or for the rest of the lease term excluding the CAM charges as he is still liable to pay those to manage and maintain the space. The other option will be to defer a portion of the tenant’s rent temporarily, but the tenant would have to repay the deferred rent at a later time, either in a lump sum or by increasing subsequent payments as the business grows. Loan Conversion is another option Rather than abating past due rent, a landlord may agree to convert the past due rent into a loan payable over time. The tenant would, however, continue to pay the current rent.

Hope this article gives you a peek in what’s happening in our valley. As always, I love your comments & feedback. Please keep them coming at aar-tie@aartieaiyer.com or call me at 480-242-8573. For your next real estate purchase please call me for Buying, Selling, Leasing and Property Management. We are full service company! work with an expert and see the difference!

Disclaimer: This article makes no representation or warranties of any kind as to the accuracy of the data. The source of data has been taken from several sources online.

Real Estate News of Arizona – August 2020

Hello friends!This has been a different summer and an un-usual beginning of school season for everyone. Everything being online, contact-less...