Hello Friends,

Can’t believe we are in the 2nd month of 2018, time flies so fast! Spring is just round the corner; real estate market had seen some changes last year, here is a comparable from 2016 to 2017, just to give you all an idea of how our valley is doing in terms of sales.

In 2016, 105,592 homes sold in Maricopa County. In 2017 the number of homes sold rose to 113,367. Reviewing the way purchases were financed throughout the year will give us insight into the type and quality of buyers driving our market. We like to view financing from two angles through the sales volume by loan type and again through the composition of sales by loan type. The two most noticeable changes took place with conventional and FHA loans, there were 8,819 more conventional loans and 3,283 fewer FHA loans made in 2017 compared to 2016. Cash buyers accounted for 21.8% of all purchases in 2017 compared to 21.9% in 2016, the same percentage of buyers are financing their purchases as in 2016. Of those financing their home purchases, a greater percentage of homebuyers chose conventional financing over FHA.

Interest rates are on a rise, according to Mortgage Bankers Association 30years mortgage rates will increase in this year. Last year they had an increment for 4 times, and predicting 2018 it will continue the trend to rise. In a context of economic growth, a strengthening job market, and rising inflation, forecast is that the Federal Reserve will increase the rates in coming year, here is a chart for closed loans on conventional and FHA.

Now let’s take a look at the December sales of Residential Properties in Maricopa County-

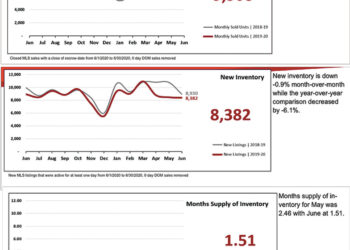

â— Total Sales for Single Family, Town-home, Condos, for December are 6,239 whereas November were 6,221 and October was 7,226

â— The Active listings for Single Family, Town-home, Condos, for December are 15,890 whereas November were 17,933 and October was 21,587

â— Pending sales for Single Family, Town-home, Condos, for December are 3,914 whereas November were 5,518 and October was 6,138

The total home sales by financing were-

Cash Sales – 1,550

Conventional – 3,819

FHA – 1,107

VA- 491

Let’s take a look at the December sales of Residential Properties in Pinal County-

â— Total Sales for Single Family, Town-homes, Condos, for December are 632 whereas November were 720 and October was 688

â— The Active listings for Single Family, Town-homes, Condos, for December are 1,732 whereas November were 1,872 and October was 1,864

â— Pending sales for Single Family, Town-homes, Condos, for December are 412 whereas November were 601 and October was 632

Let’s look at the foreclosure process in Arizona, it’s the first publicly recorded document in the foreclosure process is the notice of trustee sale. If the noticed property goes all the way through the foreclosure process, a Trustee’s Deed will be recorded, the words “in foreclosure” describes home with an active notice and “foreclosure” to describe homes that were sold or reverted at auction. Even though foreclosures don’t grab the same attention they did in 2009 thru 2013, they are still an important metric to watch.

Foreclosure activity in Maricopa County has been declining since 2009. That’s eight straight years, there were 7,520 notice of trustee sales filed on residential properties in Maricopa and 3,094 residential foreclosures in 2016. This compares to 6,694 notices and 2,302 recorded residential trustee’s deeds in 2017. There were 11.0% fewer notices and 25.6% fewer foreclosures in Maricopa County in 2017. Foreclosure activity has been declining with the fact that most of foreclosures are still coming from the epicenter of the housing bubble. This pool of distressed homes has been the driving metric of forecloses for nearly a decade. The pool of bad loans during the bubble will eventually dry up, however, the lingering effects are still present. The chart below shows you the number of Notices and Trustee Deeds recorded in 2016 and 2017 based on the year the deed of trust being foreclosed on was recorded.

Now let’s take a peek in commercial side-

Scottsdale based STORE Capital Corp a triple net lease REIT whose name is an acronym for Single Tenant Operational Real Estate, recently acquired a two building industrial portfolio located in Chandler and Roseville, CA from Erickson Framing Operations LLC.The sale/leaseback included the single story 56,000 square foot lumber yard in Roseville, CA and a 79,000 square foot manufacturing building in Chandler.

The Bourn Companies said it will develop a new 200,000 square foot office building in Tucson to serve as a regional headquarters for GEICO Insurance. The new building will occupy a 20 acre site, it will become the first major company to locate in the new 115 acre section of the The Bridges, a 350 acre mixed use development that also includes the University of Arizona (UA) Tech Park and the Tucson Marketplace regional shopping center.

Geringer Capital, a CA based investment firm that provides management services, and DOMUS Multifamily Real Estate Fund, based in Australia, purchased the 10 building Ventana Palms complex in Phoenix. It was built in 1989 and consists of one, two and three bedroom units on more than six acres.

The Avalon apartment complex in Phoenix was sold to a San Diego based Pathfinder Partners company. The apartment complex consists of seven buildings with 96,750 square feet of space with a unit mix consisting of 69% single-bedroom units and 31% double-bedroom units.

Hope this article gives you a peek in what’s happening in our valley. As always, I love your questions, comments & feedback. Please keep them coming at arti@artiiyer.com or call me at 480-242-8573.

Disclaimer: This article makes no representation or warranties of any kind as to the accuracy of the data. The source of data has been taken from several sources such as Armls, cromford report, Better Homes and Garden, Costar, Globest, BizJournal, Newsgeni, Realty times, azcentral, wall street journa