Hello friends!

This has been a different summer and an un-usual beginning of school season for everyone. Everything being online, contact-less and a work-from-home being a new normal. The beginning of Covid-19 impacted the real-estate market but to my surprise, the market started picking up towards the end-of-summer, driven by low interest rates, a shortage of inventory and movement from neighboring states into Arizona. let’s see how the market performed last month –

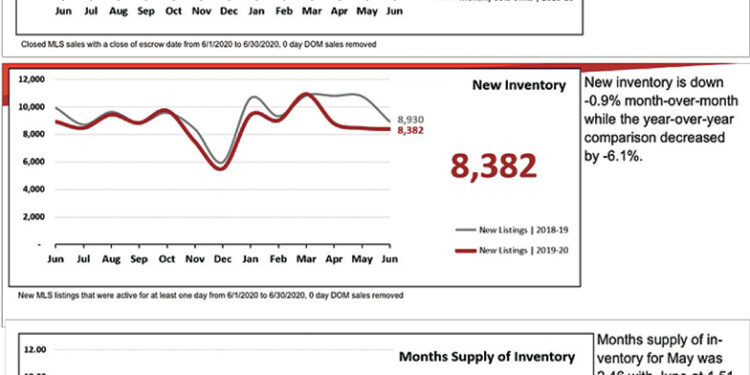

During a normal year, our home buying/selling season kicks off with the Super Bowl and then slows as our summer temperatures rise with pending contracts peaking in late April and home closings topping out in May and June. As per armls the pending contracts hit their current highwater mark on June 29, and there is still a good chance we might report an even higher number of pending contracts in the weeks to come. Everything is kind of standstill and people are force to work from home then why not a home? The buyers that had the courage to venture out in March and April not only faced less competition, they were also able to capitalize on lower prices due to panic selling. Those days are over for now. The chart below compares the number of properties under contract to the number of active listings in Maricopa County.The one segment of our housing market that was unfazed by the “Corona Pause” was new construction. Newly built homes sold in the second quarter of 2020 exceeded the number sold in 2019 for the same period. An amazing result considering the dire March predictions. The median sales price for newly built homes has been rising at a much slower rate over the last several years than the resale market. The gap between a median priced resale home in Maricopa County and a median priced newly built home in Maricopa County is about $60,000. Put in terms of a monthly payment, with the current extremely low interest rates, the difference is about $170 per month. For investors the mantra is buy and hold of purchasing new builds for their portfolio, as it works for them to build their equity in couple of years.

A new era has begun at the Star Valley masterplanned community in Tucson’s southwest submarket. Richmond American Homes and Meritage Homes each purchased lots for a combined total of 245 lots that will signal the restart of this community, that has been quiet for almost a decade. It is a Master Planned Community about 14 miles Southwest of Tucson. It is located in the valley of the Tucson Mountain Range. Star Valley Tucson boasts two dog friendly parks, jog-ging path, children play areas and BBQ’s.

Now let’s see how valley is doing, here is a look for August sales of Residential Properties in Maricopa County, please note this does not include new builts, this stats are of listings which are on ARMLS.

â—Total Sales for Single Family, Town-home, Condos for June are 8,059 whereas, May was 5,758 and April were 5,927

â—The Active listings for Single Family, Town-home, Condos for June are 11,258 whereas, May was 13,686 and April were 14,350

â—Pending sales for Single Family, Town-home, Condos for June are 7,570 whe-reas, May was 5,930 and April were 5,299

The closings by financing in last 3 months were, new builds financing is mostly conventional.

Cash Sales- June- 878, May-638, April- 731

Conventional- June- 4,933, May- 3,420, April-3,558

FHA- June- 1,237, May- 905, April-859

VA- June- 592, May- 487, April- 466

Here are the metrics for quarter 2 for Maricopa and Pinal County-

Last month in STAT, the median sales price was projected for June was $300,000. The June reported median was $305,000. Looking ahead to July, the median sales price will increase. The ARMLS Pending Price index is projecting a median sales price of $310,000.

Let’s take a look at the June sales of Residential Properties in Pinal County, again the new builds are not in this stats, and Pinal county has lot of new construction, this numbers are of listings which are on ARMLS

â—Total Sales for Single Family, Town-home, Condos for June are 941 whereas, May was 767 and April were 777

â—The Active listings for Single Family, Town-homes, Condos for June are 1,185 whereas, May was 1,458 and April were 1,648

â—Pending sales for Single Family, Town-homes, Condos for June are 1,076 whe-reas, May was 881 and April were 800

Multifamily rents in the U.S dropped by $2 in June to $1,457, following a four-month trend of declining rents, according to Yardi Matrix’s June 2020 National Multifamily Report. Since January, average multifamily rents have decreased by $12.For the first time since December 2010, year-over-year rent growth shifted to negative, falling to -0.4 percent in June, a 70basispoint decline from May. If com-pared to last year, when the first half of the year saw 2.6% rent growth and 1.2% growth in the second quarter.With the aid of benefits from the CARES Act, July 2020 rent collections, thus far, have not seen a big hit, with collections about 2 percent below what they were the same time one year ago. However, with the expiration date of these benefits in sight, August may paint a more accurate picture of renters’ financial situation, unless the government extends benefits with a new stimulus package.

Chandler industrial building in talk for sale, its a 96,000squarefoot building. The property features 4,405square feet of office space, 22-foot clear height, 11 dock-high doors, one gradelevel door and up to 189 parking spaces. It is located in the heart of West Chandler’s infill manufacturing district offers access to Interstate10 and the Loop 202, which now provides access to the Southwest Valley labor pool.

Hope this article gives you a peek in what’s happening in our valley. As always, I love your comments & feedback. Please keep them coming at aar-tie@aartieaiyer.com or call me at 480-242-8573. For your next real estate purchase please call me for Buying, Selling, Leasing and Property Management. We are full service company! work with an expert and see the difference!

Disclaimer: This article makes no representation or warranties of any kind as to the accuracy of the data. The source of data has been taken from several sources online.

Real Estate News of Arizona – May 2020

Hello friends!The upcoming months are full of anticipation and uncertainty as society begins to reopen. The strength of the economy...