Hello Friends,

We all had an unusually cold February but Holi is around the corner, that means time to celebrate the arrival of spring and triumph of good over evil with colors and music. This also means time for the valley real-estate to pick up and kick-off the home sales. At this time last year, the number of listings under contract increase daily and set up the sales volume for April, May and June.

As our new year starts to unfold, we’re entertaining two divergent theories as to what 2018 holds. Low inventory numbers will lead to higher prices and the higher prices, coupled with rising interest rates, will restrict demand and 2018 will see fewer sales than 2017. Millennials, the driving force behind our market, are one year older and their appetites and ability to purchase is increasing. That, coupled with an improving economy, will lead to increased sales in 2018.Tight supply will lead to an increase in prices, these higher prices will cool demand, lower demand will mean more supply and more supply means lower prices.

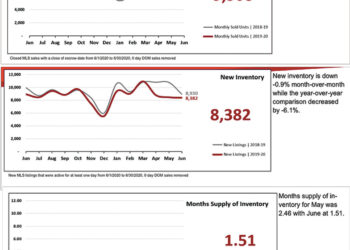

February started with 17,330 active listings not under contract, 14.8% fewer than the 20,330 in February of 2017. Low inventory and steady demand means prices will continue to rise. In January we saw a 2.5% increase in year over year sales volume and an 8.9% increase in the year over year median sales price. But low inventory numbers only tell half the story. To get the full story, we need a break down by price point. Sellers control the lower price ranges while buyers have an abundance of choices at the top of the market.

Mortgage rates were surely on a high as predicted for 2018 from the economist. Major housing agencies and groups predicted higher rates for 2018, but no one saw rates approaching these levels in the first 60 days of the year. People are thinking why interest rates on a hike, well interest rates usually rise when the economy is doing this well. In the summer of 2007, in the midst of the last boom, 30 year rates neared 6.75% according to Freddie Mac. The boom prior to that in 1999 offered rates above 8%. It is not a surprise that rates are now rising. If economic expansion continues, we could easily see 5% rates in 2018.

Now let’s take a look at the January sales of Residential Properties in Maricopa County-

â— Total Sales for Single Family, Town-home, Condos for January are 5,386 whereas, December were 6,239 and November was 6,221

â— The Active listings for Single Family, Town-home, Condos for January are 17,340 whereas, December were 15,890 and November was 17,933

â— Pending sales for Single Family, Town-home, Condos for January are 5,598 whereas December were 3,914 and November was 5,518

The total home sales by financing were-

Cash Sales – 1,425

Conventional – 2,918

FHA – 680

VA- 324

Last month STAT projected a median sales price for January of $245,000. The actual median sales price was $245,000, placing the hammer directly on the nail. Our sales volume projection for January was 6,125. The actual sales volume in January was 6,082, missing the mark by less than 1%. Looking ahead to February, the ARMLS Pending Price Index anticipates the median sales price will be $250,000. As we go towards summer the prices are going to inclined

Let’s take a look at the January sales of Residential Properties in Pinal County-

â— Total Sales for Single Family, Town-homes, Condos for January are 513 whereas, December were 632 and November was 720

â— The Active listings for Single Family, Town-homes, Condos for January are 1,912 December were 1,732 and November was 1,872

â— Pending sales for Single Family, Town-homes, Condos for January are 595 whereas December were 412 and November was 601

Now let’s take a peek in commercial side-

Toronto based Starlight Investments has acquired a new rental complex. Broadstone Fashion Center is a 335 unit low rise property in Chandler. The property’s units are a mix of studios and one and two bedroom floor plans. Onsite amenities include a pool with cabanas and a hammock area, outdoor grilling stations, a coffee bar and fitness center.

ViaWest Group acquired the 252,350 square foot Blackhawk Corporate Center in Phoenix, The three building office park was built around 1997-1998. Blackhawk Corporate Center is leased to tenants including California Casualty, Texas Back Institute, Heritage Interiors and Cox Communications.

Optima Sonoran Village, Phases I and II the multifamily complex, which was developed by Optima, comprises studios, one, two and three bedroom units in four, seven story towers. The partnership confirmed plans to develop Optima Sonoran Village Phase III, which will comprise 176 apartments in a seven story building.

Party City leased 15,068 square feet at The Market at Estrella Falls power center in Good Year. The single story, 266,548 square foot was built in 2008. The Market at Estrella Falls is anchored by Staples, Dollar Tree, Home Goods and Petco. Other tenants include 1st Choice Courier, Harkins Theatre, TJ Maxx and Burlington Coat Factory, which signed a 36,000 square foot lease in 2015.

Lina Home Furnishings, a family owned furniture chain, signed a 37,343 square-foot lease at Ahwatukee Phoenix. The single story structure, part of Ahwatukee Foothills Towne Center, totals approximately 216,000 square feet and was built in 1997. The retail building is anchored by Marshalls, Michaels and Sprouts Farmers Market. Other tenants include America’s Best Contacts, Hallmark, Party City, PetSmart and Burlington.

Hope this article gives you a peek in what’s happening in our valley. As always, I love your questions, comments & feedback. Please keep them coming at arti@artiiyer.com or call me at 480-242-8573.

Disclaimer: This article makes no representation or warranties of any kind as to the accuracy of the data. The source of data has been taken from several sources such as Armls, cromford report, Better Homes and Garden, Costar, Globest, BizJournal, Newsgeni, Realty times, azcentral, wall street journal.